Venture Capital: Istruzioni per l’uso (Come funziona e in che modo può aiutare una stratup)

Introduction to venture capital

Venture Capital is a small part of Private Equity

Venture Capital (€4.9bn, 2011)

- Cashin to finance growth

- Minority shareholders next to the entrepreneur

- Highly innovative industries

- Young companies, losing money with ambitious plans

- Pure equity risk

- Expected return above 10x over 5-7 years time horizon

Private Equity (LBO,capdev) (€34.9bn, 2011)

- Cashout to buy shares from existing shareholders

- Majority shareholder with usually new management team

- Traditional industries

- Consolidated and profitable companies

- Structured finance = lever is one of the key

- Expected return 2‐3x over 3-5 years time horizon

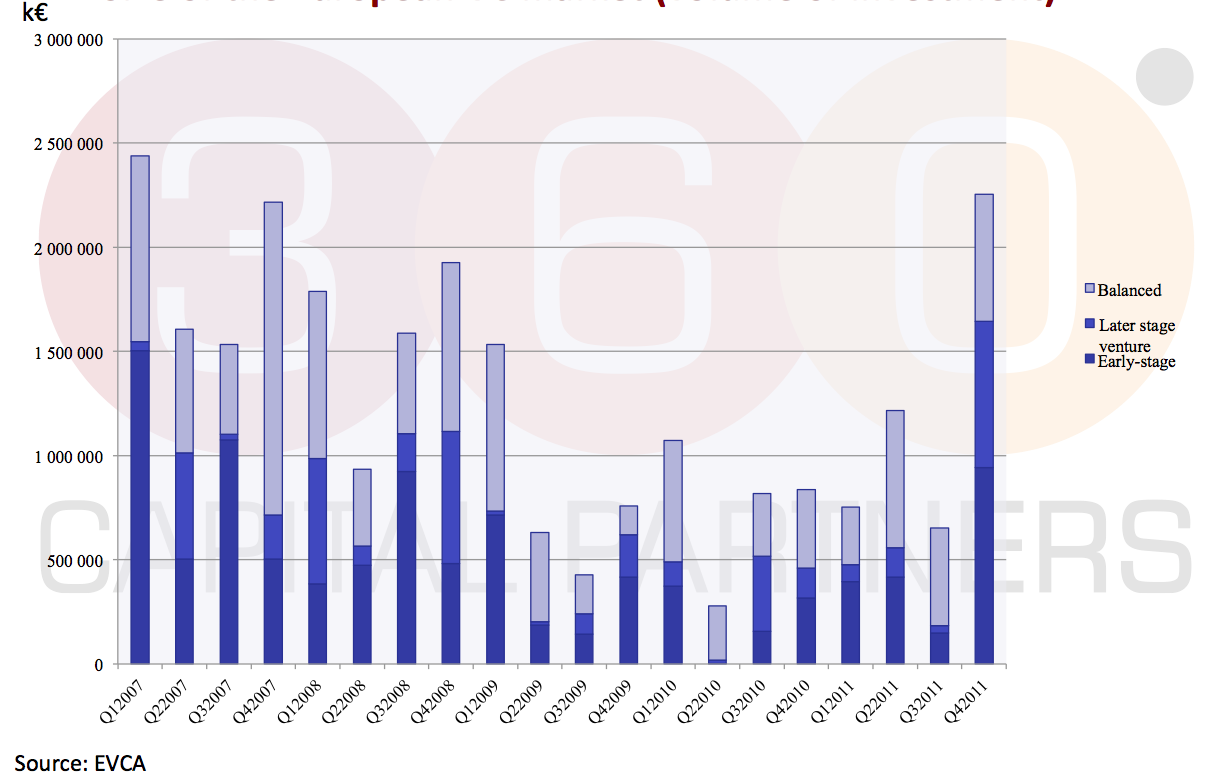

Size of the European VC market (volume of investment)

Impact on the real economy of VC investing

A recent survey on a selected number of VC-‐backed french companies in the digital industry has proved that:

- VC investing generates employment growth (not true for the rest of the economy!!) and better quality (full time vs temporary contracts) than SMEs on average

- VC backed companies hire younger people on average (31 years) and almost 13% of hirings are straight out of college

- VC backed companies invest more in R&D (2 Emes average SME) and are more internationally oriented (40% of turnover)

Venture Capital champions

Europe

USA

How does VC investing work?

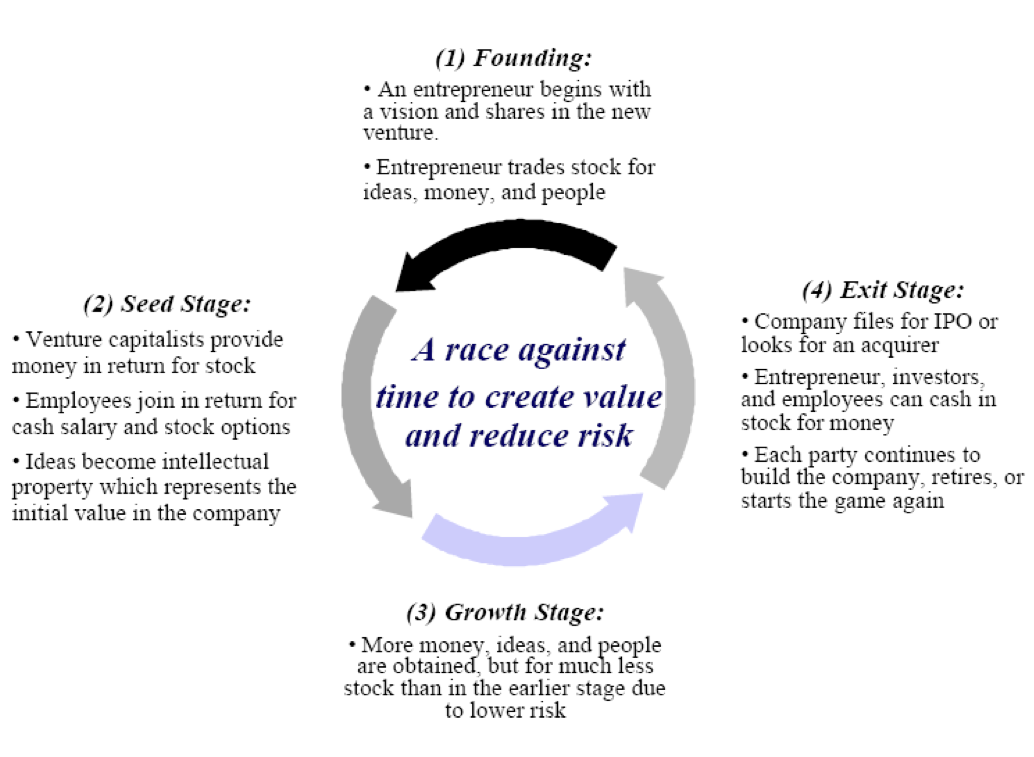

Venture Capitalist investment game

Our golden rules (investment criteria)

- The entrepreneur has to prove strong leadership, vision and passion

- The market you are adressing has to be huge

- Look at profitability!

- The right team on board (need people to push, hire slow and fire fast)

How does a Venture Capital protects its minority position ?

VCs typically take a minority stake in the company. Standard protection tools in the industry are:

- Preferred versus ordinary shares

- Liquidation preference: participating and non-participating

- Anti-dilution clauses: full ratchet or weighted average

- Corporate governance rules

How does a VC make sure that its targets are reached?

VC exit target is to be negotiated when the deal is closed

-

Exit Emeframe

-

Tag along

-

Drag along

Other standard characteristics of a VC deal:

-

Internal investors partecipation

-

Preferred dividends

-

Rights in future rounds

-

Rights of first refusal

-

Information rights

-

Management salary and commitment

How an early stage fund makes money

-

20 deals:

-

1 Blockbuster, 20x=80 M

-

1 star, 10x =40 M

-

2 successes, 5x=2x20M=40 M

-

4 average, 2‐3X =4x10M=40 M

-

6 bad investments:0,5-2x= 20 M

-

6 write offs

-

Total : 220 M, net IRR to investors 12%, carried interest 20‐25 M (for 12 years’ worth of work)

-

On any given investment, 10x must be possible

-

In a successful fund, fund managers make less money than successful entrepreneurs, which is normal, similar to average entrepreneur

-

NB: FCPI/ISF funds are different

What is the real average holding time in Europe (1)? venture5.png

How to raise VC money

How to approach a Venture capital fund

- Tell us who you are (management team CV and track record)

- Tell us what you want to do (value proposition to customer) and how (we can be your beta testers!)

- Sizing of the market

- Is there any IP protection envisageable

- Ambitious but credible financials with validated hypothesis

- Financial need and existig cap table

Few tips prior to your meeting

- Short &clear (make your investor deck short & clear)

- Get challenged (train yourself)

- Qualified endorsement (get opinion leaders on board since the beginning)

- Standard venture capital terms (be familiar with the VC legal jargon)

- Pick the right VC firm and the right person to talk to

- Feedback & next steps (ask for feedback and next steps at the end of your meeting)

Common myths

-

NDAs

-

Avoid DCF & IRR estimates